When I started counting bikes at the Kona pier in 1992 it was a 200-horse race. There were 200 bike brands ridden by the 1400 contestants, and many of the brands dominating the count back then – like Kestrel, Softride and Cannondale – are not the big brands now.

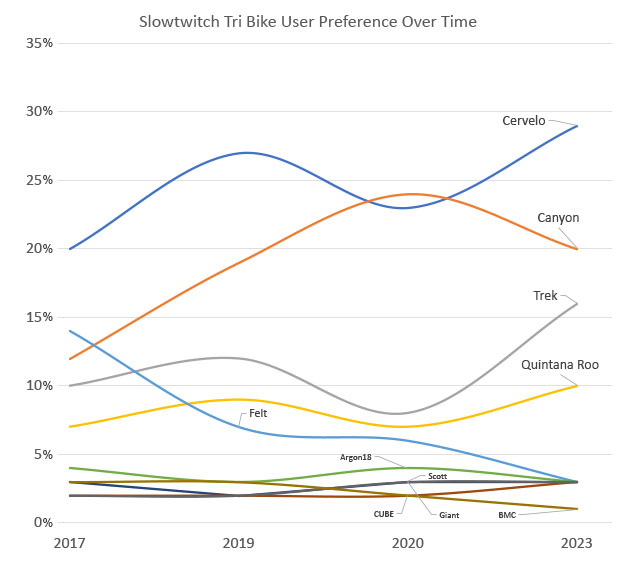

Today, among Slowtwitchers, the choice of brand has winnowed. Sure, if you go out to a big race you’ll see a lot of brands with 1 to 3 bikes in the race. But there is a trend toward consolidation and it’s no longer a 200-horse race to be the brand of tri bike that dominates sales. It’s now a 4-horse race: Cervelo, Canyon, Trek and Quintana Roo. These are the only brands in double digits (reader preference) and 3 in 4 of you have elected 1 of these brands as your favorite for your next purchase. If you’re among the one-third of our readers who live in (say) Australia, the UK, Germany you will cry foul at these results and you’re justified. Remember that our readership is two-thirds North American.

Also, bear in mind that boutique brands continue to flourish and there’s a lot of enthusiasm for CADEX, Kú Cycle, PremierBike, Dimond and dozens more but what’s notable are the big brands that are no longer there.

Other

Our most recent poll tracks the fortunes of 10 tri bike brands in 4 polls since 2017, and all the other 200 or so brands are contained in “Other.” This “brand” is now the biggest loser in our most recent tri bike poll.

In 2017 almost 25 percent of you chose a tri bike not listed among these 10. That is now down to 7 percent because a lot of you choosing "other" back in 2017 have now thrown in with 1 of these top 4 brands.

That said, note that “Other” now includes Cannondale and Specialized, companies that used to sit at the top of the tri bike seller brand list. These brands have pretty much retreated from the tri bike market.

The other big decliner is Felt. This brand enjoyed 14 percent Slowtwitcher user prefence in 2011 (see the poll below) and remained at a healthy 14 percent Slowtwitcher tri bike preference all the way up to our 2017 poll (see the chart above). Jim Felt and Bill Duehring – founders of this brand – sold their company a month before we conducted that 2017 poll. Perhaps successive owners of the brand – Rossignol Group and Pierer Mobility – chose to focus on categories other than tri. Regardless, Felt moved from 14 percent to 7 to 6 to 3 over this 6-year span of this poll.

Scott, Giant, CUBE have remained at 3 percent or very close to it throughout these polls, but all these brands do better than this in the Kona Bike Surveys. This is (I believe) because: 1) our polls are heavily North American weighted and Scott does well in Europe, while Giant does well everywhere (and especially in Europe and Australia; 2) the Kona counts are rearward looking and contain a lot of legacy bikes whereas our polls survey desire for next bike purchased. BMC sits at 1 percent in our poll, but it just launched a new tri bike and that may make an impact forward-going.

Just above is what you all said you would buy in 2011, when Canyon was not yet selling on this side of the Atlantic Ocean. Remember, this poll was taken in February of 2011 and Trek’s Speed Concept was unveiled in May and June of 2010, hence that brand’s very high ranking. As for Specialized, Chris McCormack won Kona a few months earlier and that brand had a lot of athetes under contract. Cervelo had important athletes riding its bikes as well, notably Chrissie Wellington, though Felt’s Mirinda Carfrae had won Kona in October of 2010. That 2011 poll was probably taken during the height of triathlon’s popularity, which drew keen interest from major bike brands. How things have changed!

How have the 4 brands that currently dominate our poll earned the status you’ve granted them?

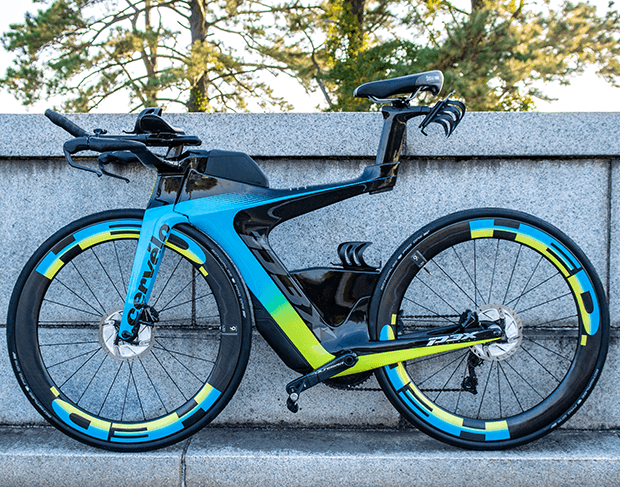

Cervelo

This brand continues to be both good and lucky. It makes terrific tri bikes and road bikes. It makes a pretty terrific gravel bike. It makes its own aerobars that work quite well, while also accommodating the aerobars made by other brands (notably Vision). Its bikes fit well, handle well, and are appropriately adjustable even when the bikes are made to optimize aero (like the S5 road bike). It’s got terrific graphics and sometimes sells bikes largely because of cosmetics. Its bikes are placed in the best pro shops. This is all because Cervelo is better at what it does than any other bike brand.

Lucky? It not only arguably makes the best bikes in class, its bikes are routinely won not only by triathletes but by pro cyclists and there’s always a bit of luck required for that. The single most likely tri bike model you’ll buy (Cervelo’s P5 Disc) is the bike that appears unbeatable underneath not just one by a pair of Jumbo Visma’s riders. But it’s not all luck if it keeps happening. This follows in the tradition of Dave Zabriskie and Fabian Cancellara being Cervelo’s most important “triathletes” for sales purposes.

We’ve polled this question – which tri bike do you intend or expect to buy next – many times since 2007. Cervelo’s current number in this poll – 29.5 percent – is the highest it’s ever been since 2007, when Cervelo’s Slowtwitch user preference number hit 31 percent.

Canyon

Canyon’s breakthrough, its secret sauce, its killer app, has been the ability to send a product direct to the consumer and actually pass (rather than just promise) the savings along to the consumer. In my opinion Canyon’s rise has not been a product play, but a sales channel play. This is not to say that Canyon doesn’t make terrific product. It does. But I’ve never felt that Canyon has made (for example) a road bike (let’s take the Ultimate, my favorite of their road bikes) that is strikingly better than a Specialized Tarmac or a Trek Madone. Rather, Canyon says (if I can put words it its mouth), “We make bikes that will stand up to any other brand’s bikes, and we trust the consumer to not need to give a third of the money they pay to a bike shop if they don’t need that bike shop.”

Now, for sure, that savings of one-third has shrunk a bit because selling bikes consumer-direct does not occur at no charge. Retailing costs, regardless of sales channel. But Canyon remains a red hot brand because of the value it delivers. It – like Cervelo, like Trek – makes its own aerobars for its higher end Speedmax tri bikes.

In my opinion, Canyon could have equaled Cervelo in this poll right now. In fact it did In our last poll, taken during the pandemic in 2020: Canyon earned 24 percent user preference and Cervelo 23 percent. Canyon had finally bridged the gap to Cervelo. What happened? Only a guess, but I think the current poll is a response to Canyon’s performance post-pandemic. The entire cycling world made bets during the pandemic, notably a wager in favor of the kind of bikes people bought in droves in 2020 and 2021. As a result, we have a huge glut of those bikes and we still haven’t been able to deliver all the tri bikes triathletes have wanted since 2019. Speedmaxes included. This is partly the fault of bike makers making poor forecasting decisions; and partly the fault of component makers who chose to produce according to those bad forecasting wagers. Canyon’s Speedmax was a casualty of the post-pandemic shipment schedules and a lot of Slowtwitchers were frustrated through not getting the bike they wanted.

Nevertheless, Canyon’s brand image is so sky-high that it continues to outpoll every brand by a pretty good margin – except for Cervelo. Canyon can earn back what it’s lost, but here’s the reality: Canyon remains sky high in user regard; but Canyon is the only one of the top-4 brands to dip in this poll since 2020.

Trek

This company decided to make the state of the art tri bike – it launched the Speed Concept in 2010 – and it was an immediate hit. There have since been 2 updates to this platform and every update has been well-received (tho many lamented the disappearance of the Speed Box). But here is an object lesson for those who – understandably! – complain about the high cost of tri bikes. Trek sits 3rd in this poll while not offering a bike that sells for less than $9,000. While you can usually get a Quintana Roo for $3,000 if you wait for the sales, QR's upscale models (e.g., X-PR and V-PR) outsell its $3,000 or $3,500 bikes. Vocal triathletes scream angrily at the high prices of tri bikes and, boy, I understand this. But the much more quiet majority of triathletes spend more money to get exactly the bike they want, and then keep that bike for many years (which we know from the data we get at the Kona Bike Count). But back to Trek…

This is one of the few companies that can afford to invest in its own aerobar design, because of the assist it gets from its Bontrager division. The aerobars, saddles and wheels are all very highly regarded because Bontrager is really a much better P&A brand than is often recognized. Two more things about this company: It and Quintana Roo follow the parallel strategy of painting at the point of sale. QR has its own version of Trek’s Project One but Trek was the brand that debuted paint-and-assemble to order. The only difference is that Trek has a brick and mortar retailer in the middle, for better or worse. (I would say for the better, except that I’m not convinced Trek’s retail stores have the expertise to perform anything other than final assembly and service.)

Trek is the brand that launched – back in 2010 when the Speed Concept first came out – a model-specific sizing scheme. This thing of, “tell me the rise and run from the BB to the armrest and I’ll tell you your exact bike prescription,” Trek started that. Trek’s management never (in my opinion) really understood bike fit, bike geometry and so on. But it’s engineers did. Down at the engineer level Trek keenly understood how to make bikes that fit and adjusted, and how to relay this info to the consumer, and whenever Trek’s management has let its engineers drive tri bike product design and fit messaging the result has been great. Whenever it hasn’t, it hasn’t.

Quintana Roo

Of course, this is the brand that arguably started it all. (If I do say so myself!) Theirs was the first bike built from the aerobars back, debuting in 1989, and always has retained that commitment to placing the rider aboard his or her bike in an optimized position. Beyond this, the hallmarks of this brand today are as follows…

The mechanics of the transaction – from idea to design to manufacture to sale to delivery – is designed for efficiency. Carbon monocoque frames are arguably most efficiently built in some country other than the United States and Cervelo, Canyon and QR do this. But these bikes are most efficiently painted here – thinks QR – and so these guys wear the bearings out on their twin paint lines painting the bikes you order from them. By doing it this way they keeping down the inventories (since it warehouses its frames ready-to-paint), and are able to deliver the bikes you want in a more timely fashion. Likewise, it assembles in its Chattanooga plant and gives you a number of assembly (e.g., Fit Ready) and shipping options. This willingness to pivot to a smarter logistical process paid off in spades as all the brands tried to work themselves out of the pandemic. Finally, QR chose to invest attention on what it does best: frame design and logistics. It forewent the manufacture of its own wheels and aerobars. This isn’t good or bad; it’s just a decision. During and since the pandemic – where tri bikes an tri accessories are still not easy to come by – that choice has paid off.